CBN Blames Exchange Rate Disparity On Import Dependence, Announces New Policy

The Central Bank of Nigeria (CBN) has blamed the current exchange rate disparity, on widespread import dependency, which it said, have wiped out most of the country’s production and manufacturing bases.

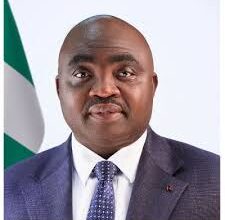

CBN Governor, Mr Godwin Emefiele spoke during the flag off of the Central Bank Digital Currency, CBDC (eNaira) in Abuja.

TheFact Nigeria reports that the CBN had embarked on a number of interventions to return the country’s economy on the sustainable growth. Hopefully, the new policy to support the private companies will boost local production and Help reduce the country’s import bills.

Mr Emefiele “recall that since the advent of the International Monetary Fund (IMF) led Structural Adjustment Programme (SAP) in 1986, and the introduction of the Second Tier Foreign Exchange (SFEM) market, the Naira has been on a one-way free fall from parity to the US Dollar in 1984 to over N410/USD today.

“Some 35 years later, we have not been able to achieve the many promises and objectives of that programme. Instead, what we have seen is widespread import dependency, which have wiped out most of our production and manufacturing bases and exported all our jobs in the process.

“What has happened to the massive textile factories across our nation such that we import almost all cotton products when we are rich in cotton?

“What has happened to our vehicle assembly plants across the nation such that we import most vehicles and have become a massive dumping ground for dying second-hand vehicles? What has happened to our rubber plantations through which we made the best tyres and rubber products in the world? What has happened to our groundnut pyramids? What has happened to our Cocoa farms? What has happened to our palm oil mills?”, he questioned.

He however, assured that the apex bank would jumpstart the productive base of the economy with the introduction of a new financial instrument to reverse the country’s over reliance on imports.

“Today, in addition to all policies and actions of the CBN to support the economy especially through the trying times of COVID-19, the apex bank is announcing a new financial instrument titled “The 100 for 100 PPP – Policy on Production and Productivity”, which will be anchored in our Development Finance Department under my direct supervision.

“Under this policy the CBN will advertise, screen, scrutinize and financially support 100 targeted private sector companies in 100 days, beginning from 01 November 2021, and rolling over every 100 days with new set of 100 companies, whose names will be published in National Dailies for Nigerians to verify and confirm.

“Working through banks, the financial instrument will be available to their customers in critical areas to boost the production and productivity, and to immediately transform and jumpstart the productive base of the economy.

“After these 100 projects by companies in the first hundred days from November 1, we will take the next 100 companies/projects for another 100 days beginning February 1, 2022, and then another 100 companies for another 100 days beginning from May 1, 2022.

“The purpose of this instrument is to take further steps to reverse our over reliance on imports.

“We believe that if we target and support the right companies and projects, we will see a significant, measurable and verifiable increase in local production and productivity, reduction in certain imports, increase in non-oil exports, and improvements in the FX-generating capacity of the economy.

“This, in my view, is the best and most sustainable way to address the Naira’s value – whether in hard currency or digital eNaira – through production, production and more production”, he said.

On foreign exchange reserves, Emefiele said, “as custodians of your national reserves, let me first assure you that there is no cause for alarm.

“Our FX reserves are strong and indeed getting stronger by the day, crossing the 40 billion USD mark, and is one of the highest in Africa – and growing. But we cannot fritter our reserves away on cheap imports and currency speculators.

“We must return to an employment-led growth anchored on productivity and rewarding producers of local goods, services, innovation and new technologies.

“If you consume cheap imports and export our jobs, we will make you pay dearly; but if you produce locally – with little or no foreign inputs beyond machinery, we will support you, and the markets will reward you abundantly”, he said.