“One of the enshrined and fundamental responsibilities of the Commission as a regulator is the protection of policyholders; hence, the Commission has placed a significant premium on prompt settlement of all genuine claims.”

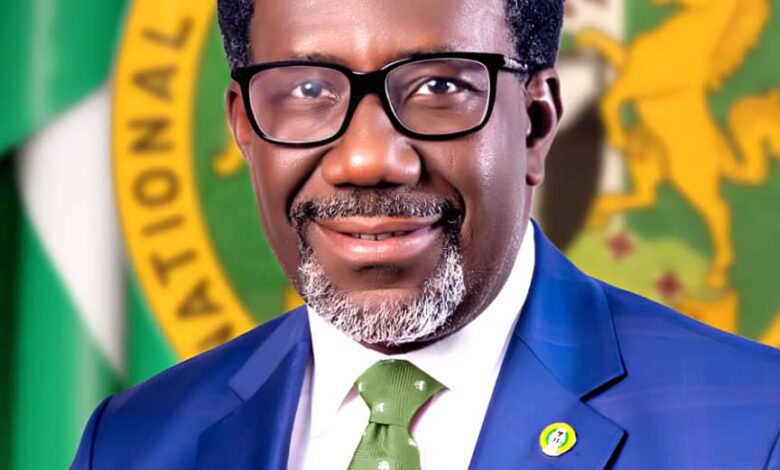

This is the words of the Commissioner for Insurance/Chief Executive Officer of the National Insurance Commission (NAICOM), Mr. Olusegun Omosehin, while speaking at the Chartered Insurance Institute of Nigeria’s Year 2024 Insurance Professionals’ Forum, held recently in Abeokuta, the Ogun State capital.

Mr. Omosehin emphasised that “the most appropriate strategy for awareness creation is a complete change of mindset on the administration and settlement of claims, prioritising our clients’ needs, treating them fairly, with utmost transparency, and timeliness, too.”.

He said the theme for this year’s forum, “The Insurance Industry: Transformation Strategies towards Expanding Market Reach,” was apt considering the recent launch of the “Nigerian Insurance Industry 10-year Transformation Roadmap,” which is the framework that is expected to guide the transformation of the insurance industry in the country in the next 10 years.

According to him, the rapid changes in the business environment and adoption of effective strategies to meet up with current realities are realities that cannot be ignored.

He said it was in recognition of this that the Commission crafted and developed its 4-year Strategic Plan (2024-2027), which took into cognizance the strategic imperatives from the industry transformation roadmap as well as the current macroeconomic realities in Nigeria as a whole.

The NAICOM boss said, cognisant of its role in the transformation agenda of the insurance sector, the Commission has set out 5 priority areas for immediate implementation, which include safeguarding policyholders and improving confidence in the industry, strengthening the Commission’s supervisory capabilities and organisational effectiveness, improving safety and soundness of the Nigerian insurance industry, fostering innovation and sustainability of the Nigerian insurance industry, and enhancing overall insurance accessibility and penetration in Nigeria.

“The policy thrusts of the Commission’s new administration will thrive on the above priorities, which will in turn shape the direction of regulation in the industry,” he said.

According to him, the Commission is undergoing structural and administrative reforms to ensure organisational and operational effectiveness.

“These reforms are expected to impact all aspects of our operation as a regulator,” Omosehin said.

He further disclosed that the Commission has created a new Directorate for Innovation and Regulation in line with the current structure to reflect the dynamism and realities of current regulatory requirements.

The Commissioner submitted that financial soundness and stability of financial institutions have become more critical than ever imagined; therefore, adoption of risk-based supervision and risk-based capital have become inevitable in the management of risks of existing and potential customers.

He maintained that the Commission, after issuance of the regulatory sandbox, which was intended to accommodate innovations, created a dedicated Innovation Hub Unit that is targeted at addressing gaps in innovation regulation and market expansion.

“In order to meet the target of market expansion and growth, the insurance industry must develop a wide range of new skill sets and orientations, attract and retain talents, diversify our product spectrum, improve our adaptability and agility, improve transparency and openness, invest in technology, improve trust and confidence in insurance, and have institutions that compete favourably with other sectors in terms of liquidity, capitalisation, and expertise. These and many more factors are to be considered if we must see the insurance industry of our dreams,” he said.

Omosehin said the Commission is prioritising the issue of accessibility to insurance products across the country and is keen about increasing penetration.

However, he stressed that “the conduct of insurance practitioners in building and maintaining trust of consumers is our primary responsibility, and that will galvanise growth and deepen penetration in the country.”.

According to him, the cooperation and support of all stakeholders is equally an integral factor to the success of the transformation strategies to be adopted for the growth and development of the industry.