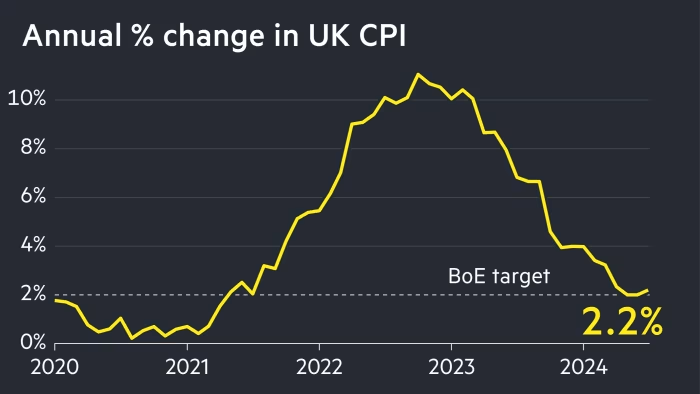

UK inflation rose less than expected to 2.2 per cent in July as underlying price pressures fell sharply, opening the door to more interest rate cuts by the Bank of England this year.

The annual increase in consumer prices, reported by the Office for National Statistics on Wednesday, came in below expectations of a rise to 2.3 per cent from economists polled by Reuters.

But the reading still marked the first rise this year and takes inflation above the BoE’s 2 per cent target.

In May, price growth eased to 2 per cent for the first time in three years and held steady in June.

The central bank had expected inflation to rise to 2.4 per cent because of a smaller fall in domestic energy bills, but slower growth in hotel costs helped pull the overall figure lower.

Services inflation, the BoE’s key measure of domestic price pressures, declined more than expected from 5.7 per cent in June to 5.2 per cent in July, the lowest since June 2022. Analysts had expected a fall to 5.5 per cent.

Ruth Gregory, economist at consultancy Capital Economics, said the “smaller-than-expected rise” in consumer prices and “the sharp fall in services inflation” would “reassure the Bank of England . . . and opens the door to more interest rate cuts later this year”.

Wednesday’s data comes after the BoE cut interest rates on August 1 for the first time since the onset of the Covid-19 pandemic.

Annual core inflation, which excludes food and energy, fell to its lowest since September 2021 at 3.3 per cent in July, down from 3.5 per cent in June.

Sterling fell slightly against the US dollar after the data release, with the pound dropping 0.1 per cent to $1.284.

UK gilts rallied, with the yield on the interest rate sensitive two-year UK gilt dipping by 0.04 percentage points to 3.56 per cent, as investors scaled up their bets on two more BoE interest rate cuts before the end of the year.

Rob Wood, economist at consultancy Pantheon Macroeconomics, said there was “no doubt” that the fall in services price growth supported BoE policymakers’ “argument that inflation pressures are gradually on their way out, warranting further interest rate cuts”.

But he warned that the decline in services inflation had been driven in part by erratic airfares and hotel prices and said the Monetary Policy Committee was unlikely to cut rates again as soon as its September meeting.

Annual price growth of restaurants and hotels dropped to 4.9 per cent in July from 6.2 per cent in June, according to the ONS, and was the largest drag on the headline rate.

The BoE expects UK inflation to increase slightly in the second half of this year but decline to 2.2 per cent by the end of 2025, to 1.7 per cent by 2026, and then to 1.5 per cent in 2027.

Official data published on Tuesday showed annual wage growth excluding bonuses, a measure of underlying price pressures, slowed to its lowest in almost two years at 5.4 per cent.

After this month’s quarter-point reduction in the benchmark interest rate to 5 per cent, BoE governor Andrew Bailey said “we need to make sure inflation stays low, and be careful not to cut interest rates too quickly or by too much”.

Catherine Mann, an external member of the MPC, this week said the UK should not be “seduced” into thinking the battle against inflation was over after a short-term drop in the headline rate.

The uptick in inflation in July had been anticipated in the Treasury and was cited by Conservative officials as a minor factor in former prime minister Rishi Sunak’s decision to hold an earlier election.

For the Labour government, the small rise in inflation is a reminder of the challenges facing chancellor Rachel Reeves, who wants to boost growth rates but knows the BoE will remain wary about cutting interest rates further in the short term.

Responding to the inflation data, Darren Jones, chief secretary to the Treasury, said the government was “under no illusion as to the scale of the challenge we have inherited”.

Shadow chancellor Jeremy Hunt said Reeves “must not use this data as an excuse to break her promises and hike up taxes”.

In the Eurozone, inflation rose to 2.6 per cent in July from 2.5 per cent in June. Later on Wednesday, separate data is expected to show US annual inflation was unchanged at 3 per cent in July. (Financial Times)