Inflation: CBN Raises Benchmark Interest Rate To 18.5%

In a move to bring to heel the rising inflation rate in Nigeria, the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) has voted to raise the benchmark interest rate by 50 basis points (18.5%) from the previous rate of 18.0 percent held in March, 2023.

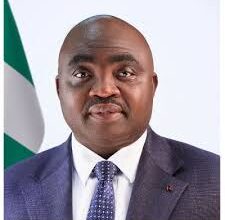

.MPC’s decision to raise the benchmark interest rate was announced by the apex bank’s Governor, Mr Godwin Emefiele while briefing newsmen shortly after the meeting, Tuesday May 24, 2023 in Abuja..

Recall, the National Bureau of Statistics (NBS) in its latest Consumer Price Index (CPI) which measures inflation said, the nation’s inflation rate increased to more than 17-year high of 22.22 percent in April, 2023, from the 22.04 recorded in March, 2023.

Emefiele said, in reviewing the argument to further hike the policy rate in a bid to subdue aggregate demand, Members noted that the current uptrend in inflationary pressure was driven by a combination of both demand and supply side issues.

He said, the MPC observed the continued upward risk to price development driven primarily by expectations of rising energy and food prices; unabating security challenges in food producing areas; as well as persisting exchange rate pressure.

“The Committee thus felt it was expedient to continue to address the demand-side issues falling within the ambit of its policy tools. The balance of the argument thus leaned sufficiently in favour of a further hike (albeit less aggressively), considering the adverse

impact of rising inflation on real income”, he noted.

The governor said, the MPC opted to tighten, though moderately, so as to:

i. indicate the MPC’s conviction that the current policy stance is moderating the rising inflation, albeit month-on-month, and sustaining the stance would consolidate the gains made so far;

ii. support the efforts toward moderating the demand-pull inflation, as cost of funds increases, and discourages further

build-up in aggregate demand, in the face of declining output

growth;

iii. narrow the negative real interest rate gap and moderate the

associated consequences, including discouraging domestic

savings mobilization and waning investors confidence;

iv. effectively moderate the monetary phenomenon in the current

drivers of inflation by tapering both economic and financial

conditions and sweep-up excess liquidity in the system; and

v. boost the Bank and Committee’s credibility following its earlier

forward guidance to continue to tighten when confronted with

unabated rising inflation.

He said, Members, thus, resolved by a unanimous vote to raise the Monetary

Policy Rate (MPR), moderately. Ten (10) members voted to raise MPR by 50 basis points and one (1) member voted to raise the MPR by 25 basis points. All members voted to keep all other parameters

constant.

In summary, he said, “the MPC voted to:

I. Raise the MPR to 18.5 per cent from 18.0 per cent; II. Retain the Asymmetric Corridor of +100/-700 basis points around the MPR; III. Retain the CRR at 32.5 per cent; and IV. Retain the Liquidity Ratio at 30 per cent”.