Naira Bounce Back: The Impact Of Cardoso’s Strategies

By Ademola Oyetunji

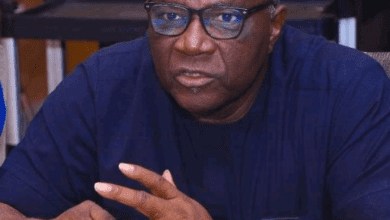

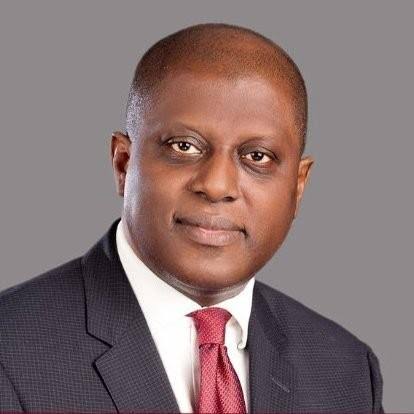

Olayemi Cardoso, the Governor of the Central Bank of Nigeria (CBN), has emerged as a central figure in the narrative of Nigeria’s economic resilience, especially in the face of the Naira crisis that has tested the fortitude of Africa’s largest economy.

His tenure, marked by decisive action and strategic foresight, has seen the Naira navigate through turbulent waters, eventually finding a steadier course amidst a sea of economic challenges.

The measures implemented under his leadership exemplify a blend of courage, innovation, and a steadfast commitment to the economic well-being of Nigerians.

Cardoso’s approach to the crisis was multi-faceted, addressing both immediate and structural issues with precision and authority. One of the first challenges he tackled was the speculation and arbitrage activities that significantly contributed to the Naira’s depreciation.

By identifying and acting against entities such as Binance Nigeria Ltd and various unregistered bureau de change operators, Cardoso cut off a significant source of pressure on the Naira. This action, along with the forensic auditing of forex obligations carried out by Deloitte Management Consulting, showcased his resolve to ensure transparency and accountability in the forex market.

Moreover, the Governor’s strategic decision to fulfill legitimate forex obligations to foreign entities and his crackdown on illicit financial flows demonstrated a keen understanding of the importance of international confidence in Nigeria’s economic policies. The successful issuance of Nigeria’s first Eurobond in two years, which was oversubscribed, is a testament to the growing trust in Nigeria’s economic direction under Cardoso’s guidance.

Cardoso’s collaboration with law enforcement agencies like the Economic and Financial Crimes Commission (EFCC) and the Nigerian Police further underscores his comprehensive approach to stabilizing the Naira. This partnership has been instrumental in curbing illegal financial activities and restoring order in the forex parallel market.

One of the boldest moves by Cardoso was at the maiden Monetary Policy Committee (MPC) meeting under his chairmanship in February 2024, raising the Monetary Policy Rate (MPR), a benchmark interest rate to 400 basis point to 22.75% from 18.75%, the asymmetric corridor around the MPR to +100/-700 basis point from +100/-300, the Cash Reserve Requirement (CRR) to 45% from 32.5% but retained Liquidity Ratio at 30%, signaled a strong commitment to taming inflation and stabilizing the economy.

These measures, while tough, were necessary to curb the excessive money supply contributing to inflation, demonstrating Cardoso’s readiness to make difficult decisions for the greater good.

Olayemi Cardoso’s leadership reflects a blend of resilience, strategic vision, and a deep-seated commitment to Nigeria’s economic stability.

His actions have not only helped in steering the Naira back to a path of recovery but have also laid the groundwork for a more robust and resilient economy.

Through a combination of rigorous policy implementation, strategic partnerships, and a clear focus on transparency and accountability, Cardoso has demonstrated an exemplary model of central banking in times of crisis.

His tenure thus far is a beacon of hope for the Nigerian economy, illustrating that with the right leadership, even the most daunting economic challenges can be navigated successfully.

Ademola Oyetunji writes from Ibadan.